Fast-growing fintech startup has grown from 4 to 25 employees in under 15 months

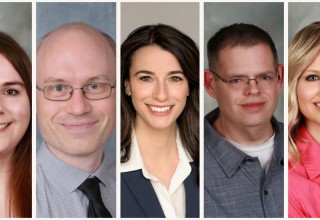

WEST DES MOINES, Iowa, June 11, 2019 (Newswire.com) - Des Moines fintech startup LenderClose has added five new employees and promoted two others this month. The new hires bring LenderClose’s total workforce to 25 employees, five of which have been added in the last 30 days.

Software engineers Matthew Brown, Phyllis Nelson and Jessica Wilson, Sales Representative Martin Pohlmeier and Executive Assistant Whitney Goodman joined the fast-growing team this month. Christen Jones and Benjamin Proffitt, both of whom joined the firm as sales development representatives in January 2019, have been promoted to sales executives.

“This team is directly responsible for making sure our rapid technology development and new client growth is accompanied by the highest quality client care and attention,” said LenderClose COO Ben Rempe. “Our credit union and community bank clients rightly expect nothing less. As LenderClose continues to push the boundaries of digital transformation in the community lending space, there are a lot of unknowns for clients. We get it. Although we strive to build the best technology solutions available, we also know they must be consumable and supported by empathetic, human-centric representatives of our brand. Our employees are second-to-none when it comes to this critical combination of hard and soft skills. And, they love what they do, which certainly helps stimulate the client-first culture of LenderClose.”

Brown, of Wauwatosa, Wisconsin, is a developer with more than 15 years’ experience solving complex technical problems in clinical settings. During his career in healthcare information technology, he led complex clinical application projects and created custom-coded solutions to address unique challenges in maintaining high-integrity clinical and laboratory testing. For LenderClose, Brown will create software development practices that shorten the systems development lifecycle while delivering frequent features, fixes and updates in close alignment with client business objectives.

Nelson, of Fort Collins, Colorado, is a developer with nearly 15 years’ experience. She most recently worked as a software developer for Hach, a maker of analytical instruments for water quality testing. Prior to that, her career included nine years as senior software specialist for Pioneer (now Corteva Agriscience) in Johnston and work as a programmer for Shazam and SourceCorp in Iowa. At LenderClose, she will work on new initiatives that expand the fintech’s product and service capabilities.

Wilson, of Des Moines, Iowa, is a UNI graduate and programmer who has created modern, full-stack web applications to meet the end-to-end business needs of more than 400 companies. She most recently worked for IMT Computer Services in West Des Moines. Wilson is experienced a variety of programming languages, as well as testing and debugging code on large projects. She will ensure LenderClose’s front-end design aligns with client expectations and will also support back-end development.

Pohlmeier of Ankeny, Iowa, joins the LenderClose sales team after nearly 20 years as the simulcast and mutuel manager for Prairie Meadows, where he managed a department of more than 50 tellers and line supervisors. He will help LenderClose develop sales leads and coordinate product demonstrations for credit unions and community banks looking to increase the digital capabilities of their lending teams.

Goodman, of Des Moines, Iowa, brings more than seven years’ administrative and operations experience to her executive assistant role supporting COO Rempe and CEO Omar Jordan. She was most recently the administrative assistant for student services at the Drake University Law School. Goodman also served as the executive assistant to the provost at Abilene Christian University and worked in various administrative and operations roles at Northwestern Mutual.

About LenderClose, Inc.

LenderClose is a powerful platform that digitizes the underwriting process and speeds up the lending cycle. The web-based hub gives loan officers instant access to the latest real estate lending technology, products and solutions so they can become dominant lenders in their local markets. To learn more, follow LenderClose on LinkedIn or at lenderclose.com.

Source: LenderClose

Share: